Chart

About Chart

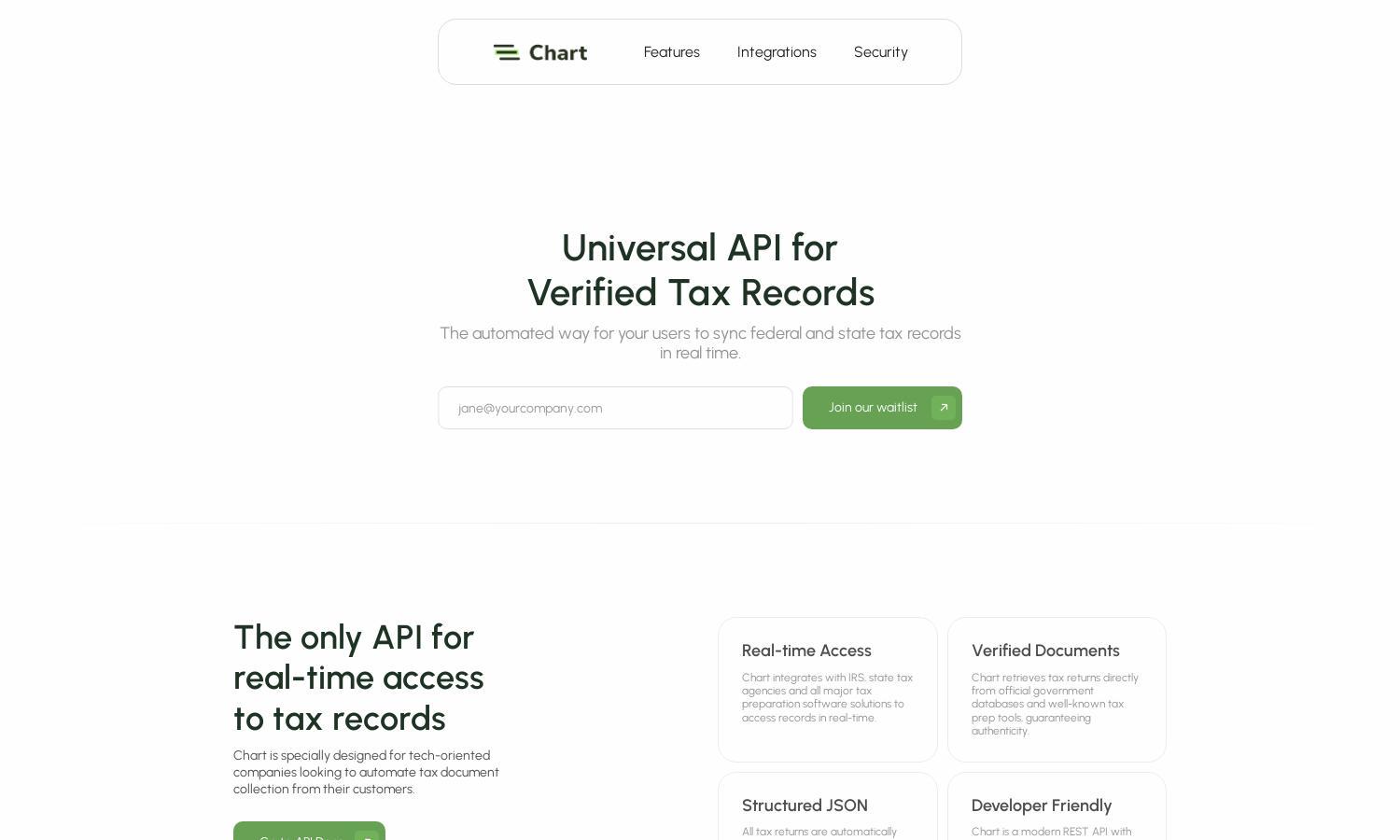

Chart is an innovative platform designed for tech-driven companies seeking efficient tax document automation. It provides real-time access to verified tax records from the IRS and state agencies, ensuring accuracy and authenticity. Users can effortlessly sync their tax records, benefiting from enhanced security and compliance with regulatory frameworks.

Chart offers flexible pricing plans to meet varying user needs, including customized enterprise solutions. Each subscription tier provides access to premium features, such as advanced security protocols and comprehensive reporting options. Users who upgrade enjoy greater document access and a more seamless tax document collection experience with Chart.

Chart boasts a user-friendly interface designed for easy navigation and quick access to essential features. With a clean layout and intuitive controls, users can efficiently manage tax records and submissions. Unique features enhance the browsing experience, making Chart a valuable tool for tech-oriented companies focused on automating tax-related tasks.

How Chart works

Users start by signing up on Chart, where they can connect their IRS and state tax accounts or upload tax documents directly. Once onboarded, users can navigate through a straightforward interface to access real-time verified tax records, ensuring the automation process for tax document collection is smooth and efficient. Chart prioritizes security and simplicity, allowing users to access their data without the hassle of manual document handling.

Key Features for Chart

Real-time Access

Chart’s real-time access feature allows users to instantly retrieve verified tax records from IRS and state agencies. This unique capability streamlines the tax document collection process, enhancing efficiency and accuracy for tech-oriented companies seeking to automate client interactions.

Verified Documents

Chart ensures the authenticity of tax documents by retrieving them directly from official databases and tax preparation software. This feature enhances trust among users, allowing tech companies to confidently automate tax document collection with verified information and compliance in mind.

Structured JSON Processing

Chart processes tax returns using OCR technology, converting them into well-structured JSON objects. This key feature facilitates easy integration and data handling for developers, making it simpler for tech companies to work with tax documents and automate various workflows efficiently.

You may also like: