CPA Pilot

About CPA Pilot

CPA Pilot is an advanced AI Tax Assistant tailored for tax professionals, enhancing their workflow efficiency. By leveraging authoritative sources and GPT-4 technology, it provides precise answers to complex tax inquiries. This innovative tool simplifies research and client communication, ultimately improving service quality and satisfaction.

CPA Pilot offers flexible pricing plans catering to different user requirements. The Light, Average, and Power user plans provide varying message limits and features with a 7-day free trial for new users. Upgrading ensures access to more messages and advanced capabilities, enhancing overall productivity and user experience.

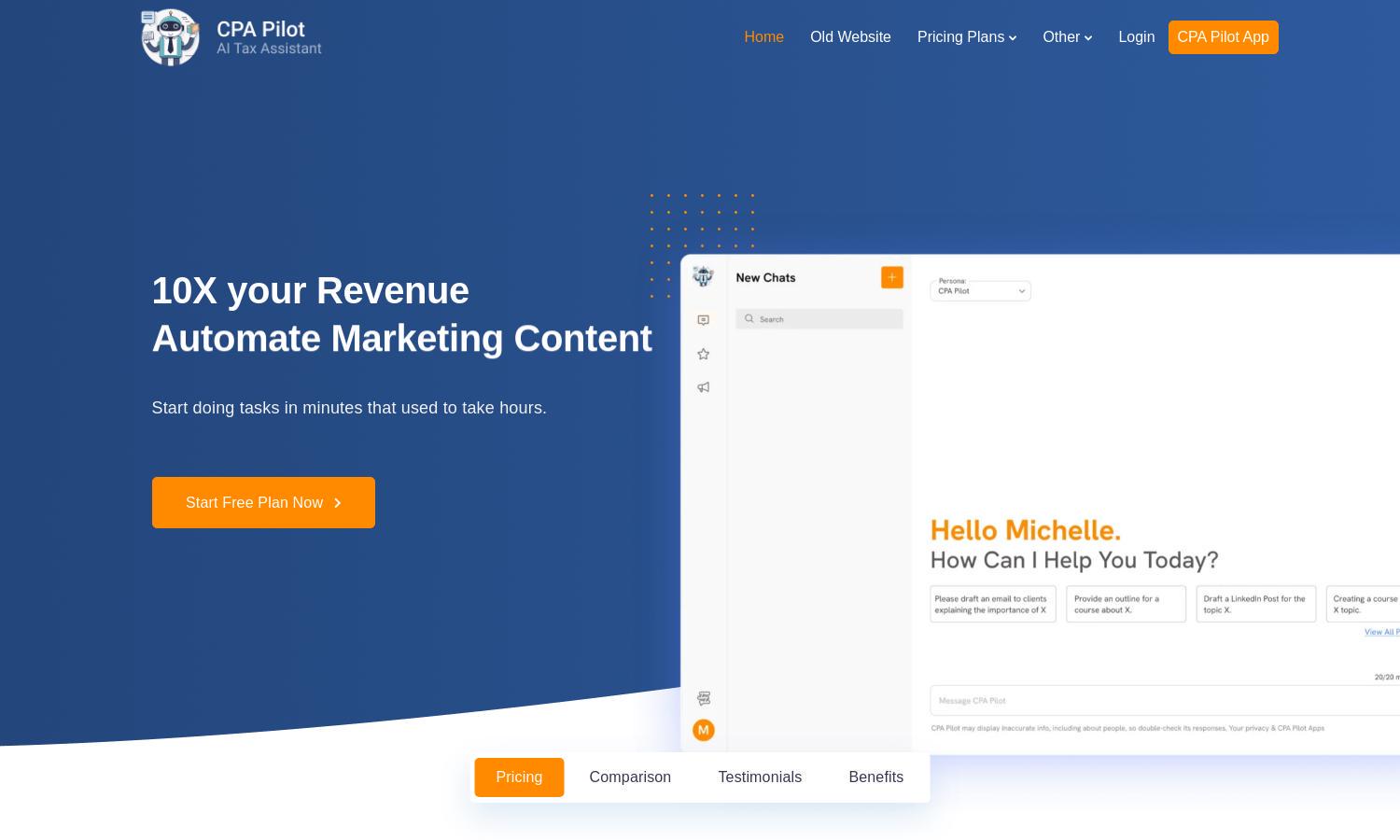

The user interface of CPA Pilot is intuitively designed for easy navigation, allowing tax professionals to access vital features effortlessly. Its layout supports seamless browsing, optimizing the user experience. Unique functionalities, such as 24/7 access to authoritative tax resources, make CPA Pilot indispensable for efficient tax management.

How CPA Pilot works

Users start by signing up for CPA Pilot, where a free 7-day trial allows them to explore the platform’s features. After onboarding, they can easily navigate through its intuitive interface to access tax codes, client communication tools, and research capabilities. With real-time support and AI-driven insights, users can enhance their practice significantly.

Key Features for CPA Pilot

AI-Driven Tax Research

CPA Pilot’s AI-driven tax research capability provides users with quick, accurate answers to intricate tax inquiries. By leveraging authoritative sources, CPA Pilot ensures tax professionals have reliable information at their fingertips, boosting confidence and saving valuable time.

Instant Technical Support

CPA Pilot offers instant technical support, enabling users to receive immediate assistance with their tax software queries. This feature eliminates the hassle of contacting customer service or searching online for answers, enhancing overall user satisfaction and efficiency.

Comprehensive Tax Codes Access

With access to comprehensive tax codes for all 50 states, CPA Pilot equips tax professionals with essential information. This feature allows for informed decision-making and simplifies complex tax scenarios, significantly benefiting users in their practice.