Addy AI

About Addy AI

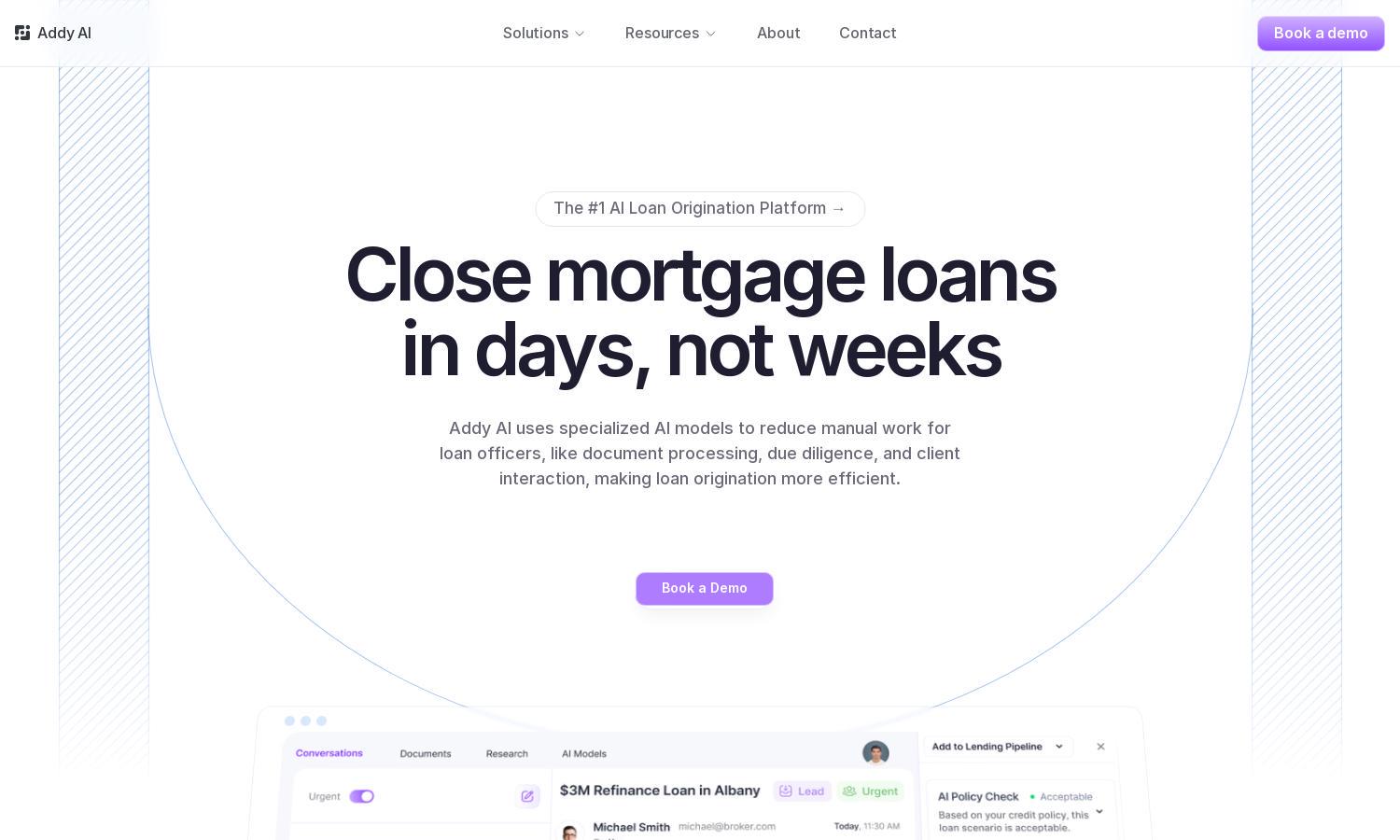

Addy AI enhances mortgage lending efficiency by empowering lenders with custom AI models that automate loan origination 24/7. Designed for mortgage lenders and banks, it helps reduce manual work significantly and improves client experience. With its innovative technology, Addy AI is the ultimate solution to streamline operations.

Pricing for Addy AI includes various tiers designed to fit diverse lender needs. Each plan offers unique features aimed at maximizing efficiency and automation in the mortgage process. Upgrading can unlock advanced AI functionalities that further enhance workflow. Explore potential discounts for long-term engagements; Addy AI adapts to your requirements!

Addy AI's user interface is intuitive and designed for seamless navigation, enhancing user experience. The layout ensures quick access to core features, minimizing context-switching. Its user-friendly design makes it easy for mortgage lenders to integrate and utilize the platform effectively, promoting a fluid workflow throughout the loan origination process.

How Addy AI works

Users begin their journey with Addy AI by signing up and onboarding through an easy process. Once registered, they can seamlessly integrate their CRM and other systems. The platform allows users to train custom AI models that handle various tasks in loan origination, such as document processing and client interactions, maximizing their efficiency.

Key Features for Addy AI

Custom AI Models for Automation

Addy AI's custom AI models revolutionize mortgage lending by automating repetitive tasks, allowing lenders to save precious time. This unique feature enhances operational efficiency, ensuring that loan officers can focus on critical decision-making and client relationships, ultimately leading to faster loan closing.

Instant Loan Assessments

With Addy AI, users receive instant loan assessments that quickly check credit policy compliance. This key feature not only increases processing efficiency but also provides actionable suggestions for borrowers to enhance their eligibility, streamlining the overall lending process and improving client satisfaction.

Document Processing with AI

The document processing feature of Addy AI utilizes state-of-the-art computer vision to extract relevant data from mortgage documents. This capability streamlines data capture, reducing the time spent on manual reviews and ensuring that loan officers can retrieve essential information effortlessly, enhancing workflow productivity.

You may also like: