finbots.ai

About finbots.ai

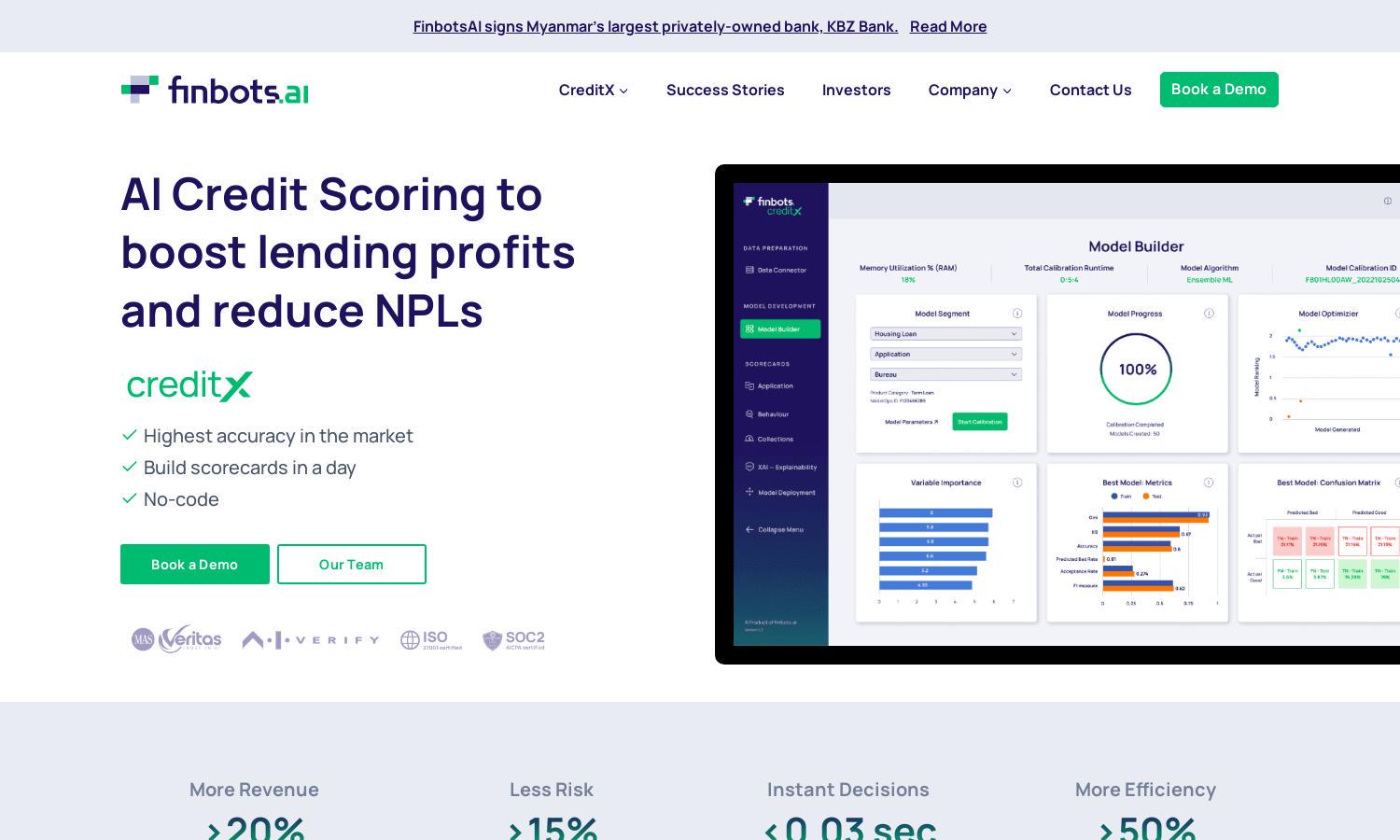

Finbots.ai revolutionizes lending with its AI credit risk platform, CreditX. Tailored for banks and lenders, it offers fast, highly accurate scorecard generation and deployment, helping financial institutions enhance decision-making processes and reduce risks. This innovative solution is designed to optimize credit scoring and improve overall lending efficiency.

Finbots.ai offers flexible pricing plans suitable for banks and fintech startups. Each plan delivers distinct value, ensuring compliance while maximizing profitability. A special discount of 30% off for the first six months enhances access to state-of-the-art AI technology, making it a compelling choice for lenders aiming to elevate their operations.

The user interface of finbots.ai is designed for intuitive navigation and seamless interaction. With a clean layout and user-friendly features, users can quickly access essential tools, build custom scorecards, and deploy solutions efficiently. This streamlined design enhances the overall experience, making it easier for lenders to leverage AI technologies in credit risk management.

How finbots.ai works

Users interact with finbots.ai by signing up and onboarding, where they connect their internal and external data sources to the platform. The powerful AI then automates the creation of custom scorecards, enabling real-time decision-making and monitoring. Users can easily deploy their models and access comprehensive analytics, ensuring optimal lending strategies with minimal effort.

Key Features for finbots.ai

Rapid Scorecard Deployment

Finbots.ai's rapid scorecard deployment is a standout feature simplifying the lending process. Users can build and launch custom scorecards in just a day using advanced AI algorithms, dramatically reducing the time to implement effective credit risk assessments and improving lending profitability.

Automated Data Validation

Automated data validation is a critical feature of finbots.ai that enhances the accuracy of credit scoring. By seamlessly validating and transforming data from various sources, the platform ensures that lending decisions are based on reliable and relevant information, empowering lenders to make informed choices.

Compliance and Regulation Proof

Finbots.ai ensures users remain compliant with regulations through its robust framework. The platform is designed to meet data privacy standards and provide necessary documentation for regulatory authorities, allowing lenders to focus on growth while maintaining adherence to legal requirements.

You may also like: