Jinnee

About Jinnee

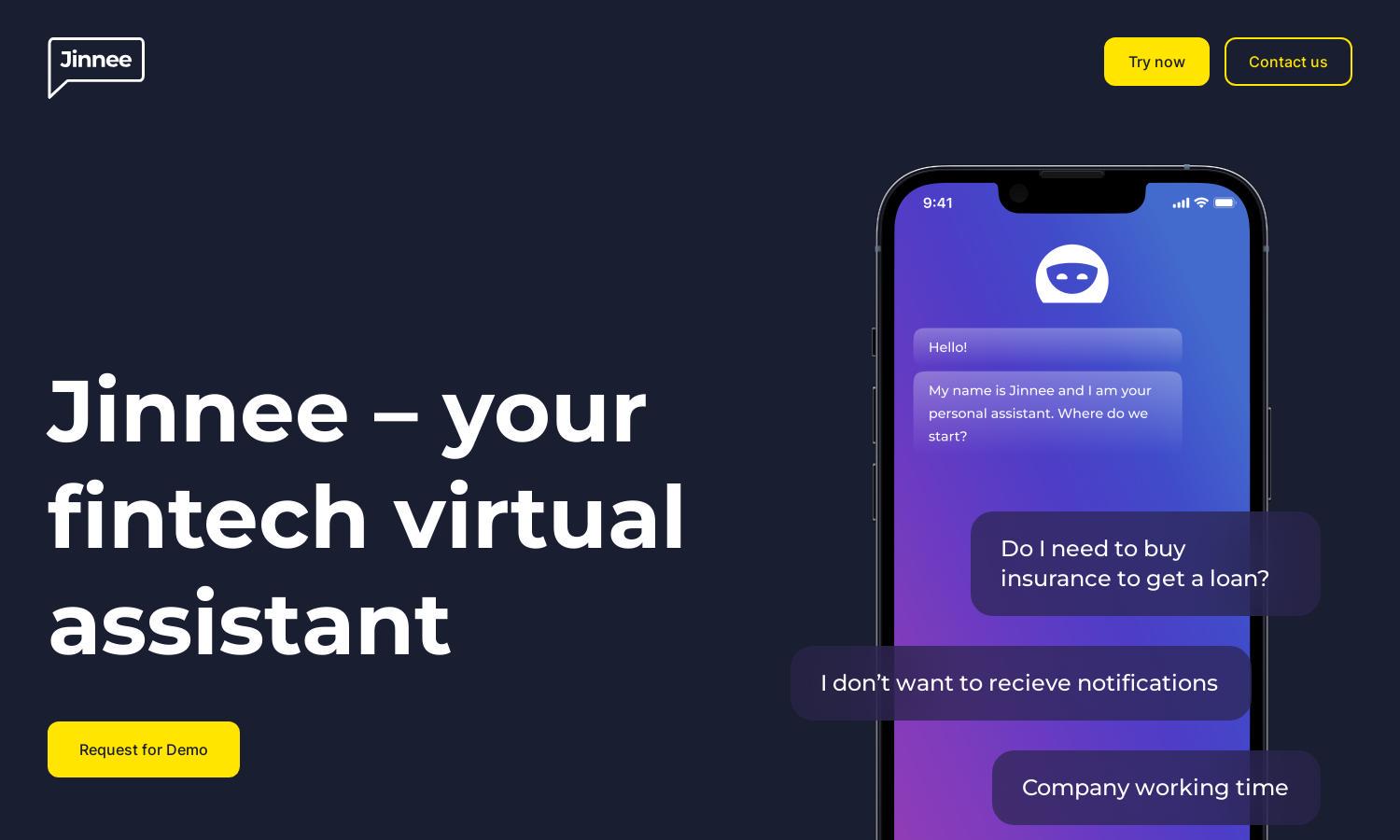

Jinnee is a cutting-edge AI virtual assistant designed for fintech businesses, aimed at enhancing client engagement through 24/7 support. This intelligent system quickly addresses customer queries, offers personalized banking advice, and learns from each interaction to continuously refine its services, ultimately improving user satisfaction.

Jinnee offers flexible pricing plans tailored to suit various fintech needs, with tiered subscription options that deliver significant value based on features and support levels. Upgrading unlocks advanced analytics and dedicated support to maximize user experience, catering to businesses of all sizes with competitive pricing.

Jinnee's user interface is designed for simplicity and ease of navigation, ensuring users can quickly access features and analytics. The layout minimizes clutter while incorporating intuitive design elements that enhance user engagement. This focus on user experience helps streamline interactions, maximizing efficiency for fintech operations.

How Jinnee works

Users begin their journey with Jinnee by signing up and customizing their virtual assistant interface based on specific needs. After onboarding, they can easily navigate features like personalized banking recommendations, automated customer support, and insightful analytics. The AI learns from interactions, continually improving response quality to provide seamless user experiences.

Key Features for Jinnee

24/7 Customer Support

Jinnee provides 24/7 customer support, ensuring that clients receive immediate assistance regardless of the time or location. This feature significantly reduces response times and enhances customer satisfaction, positioning Jinnee as an invaluable resource for fintech companies seeking to improve their client interactions.

Personalized Banking Services

Jinnee acts as a personalized virtual financial advisor, delivering tailored banking advice to clients. By understanding individual needs and preferences, Jinnee offers relevant solutions and financial products, enhancing user experience and fostering long-term customer loyalty within the fintech industry.

Automated Learning

Jinnee's automated learning feature enables the AI to adapt based on user interactions and inquiries. This continuous evolution allows it to provide increasingly relevant responses and solutions, setting Jinnee apart as a dynamic assistant capable of growing with its users’ needs.