Best Personal Finance products (2+)

Discover 2+ best personal finance products. Compare features, pricing, and reviews. Free and paid options available.

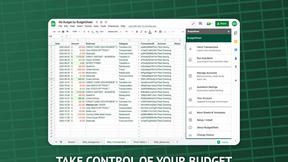

BudgetSheet

BudgetSheet seamlessly imports your bank transactions into Google Sheets for effortless budgeting and expense tracking.

Finanz

Finanz boosts your financial literacy in just five minutes daily, making money management and investing stress-free.

FAQs for Personal Finance

What are the key benefits of using budgeting tools in the Personal Finance Category?

Budgeting tools in the Personal Finance Category offer crucial benefits, including streamlined tracking of income and expenses. They enable users to identify spending patterns and areas for improvement, allowing for more effective financial management. By fostering discipline and clarity, these tools help users achieve their financial goals.

How does investment guidance improve financial decision-making in the Personal Finance Category?

Investment guidance within the Personal Finance Category significantly enhances financial decision-making by providing users with tailored insights into investment options. This feature helps users evaluate risks and rewards, fostering informed choices that align with their financial goals, ultimately leading to smarter investment strategies.

What unique features does the Personal Finance Category offer for savings optimization?

The Personal Finance Category provides unique savings optimization features that help users compare high-yield savings accounts and identify effective savings strategies. By highlighting options that maximize interest earnings, users can build their savings more efficiently, securing their financial futures through informed decisions.

How does the Personal Finance Category stand out from other financial management tools?

The Personal Finance Category stands out due to its comprehensive approach, integrating budgeting, investment, and savings tools in one user-friendly platform. This unique blend of functionalities ensures users can manage their finances holistically, addressing diverse needs while empowering them to make better financial decisions.

How can users benefit from investment tools in the Personal Finance Category?

Users can greatly benefit from investment tools in the Personal Finance Category by accessing tailored recommendations that guide them toward suitable investment options. These tools enhance users’ understanding of market dynamics, enabling them to build diversified portfolios and make strategic investments that align with their financial goals.

What features help users effectively manage their finances through the Personal Finance Category?

The Personal Finance Category offers features like intuitive budgeting tools, comprehensive investment guidance, and savings optimization resources that collectively help users manage their finances effectively. By simplifying financial tracking and planning, users gain clarity and control over their financial situations, enhancing their overall financial health.

You may also like

Trading

The Trading Category offers specialized AI resources for enhanced trading efficiency.

Analytics & Data

Analytics & Data Category empowers organizations to make data-driven decisions efficiently.

Marketing

The Marketing Category simplifies digital campaigns, offering essential tools for marketers.

AI Assistants

AI Assistants Category automates tasks, enhancing efficiency with 24/7 support.

Robotics

The Robotics Category showcases automation solutions that boost productivity and efficiency.

Customer Support

The Customer Support Category streamlines support interactions, enhancing satisfaction through targeted assistance.

VR & AR

Discover the VR & AR Category, enhancing user engagement through immersive experiences.

Copywriting

The Copywriting Category focuses on persuasive content creation, enhancing engagement and conversions.