Kintsugi

About Kintsugi

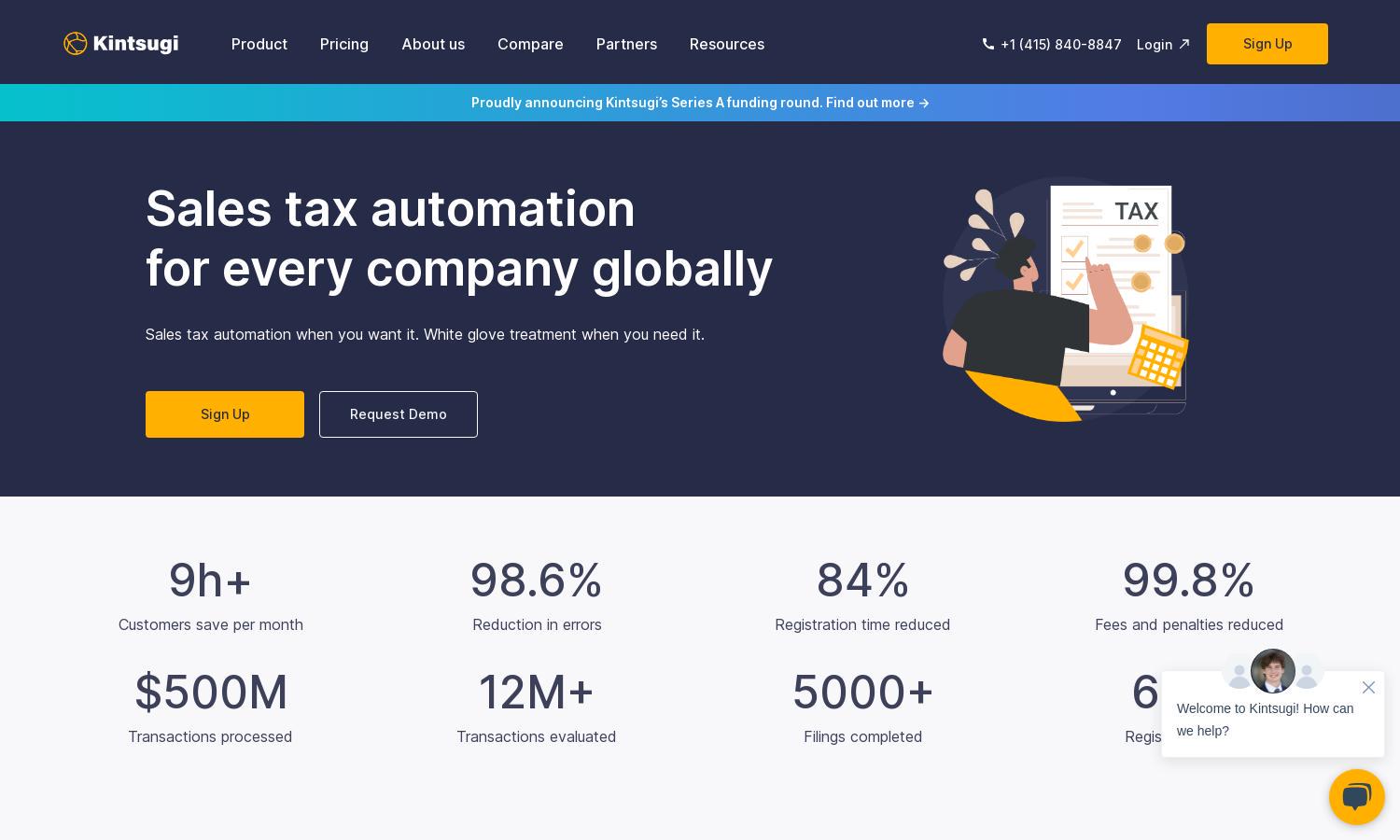

Kintsugi is a leading Sales Tax Automation platform aimed at businesses seeking streamlined compliance solutions. Its innovative feature automates tax calculations, address validations, and product categorizations. Kintsugi empowers users by simplifying sales tax reporting, reducing liabilities, and ensuring compliance, ultimately allowing companies to focus on their growth.

Kintsugi offers flexible pricing with no onboarding or implementation fees, allowing users to pay month-to-month. Each subscription tier provides automated sales tax filing, with benefits including timely compliance and reduced penalties. Special discounts may apply, making Kintsugi an excellent choice for cost-effective sales tax solutions.

Kintsugi's user interface is designed for a seamless experience with intuitive navigation and straightforward features. Users can easily connect systems and access tax data, enhancing efficiency in sales tax management. The dashboard provides clear insights, ensuring Kintsugi users enjoy a smooth and user-friendly journey throughout the platform.

How Kintsugi works

Users begin their journey with Kintsugi by easily signing up and connecting their billing, payment, and HR systems. The platform automatically registers them in relevant states and ensures accurate sales tax collection. Users can then monitor their liabilities in real-time, file reports effortlessly, and enjoy automated compliance alerts to alleviate stress.

Key Features for Kintsugi

Automated Tax Calculation

Kintsugi's Automated Tax Calculation feature ensures that businesses always collect the correct sales tax. This unique functionality minimizes errors and simplifies compliance for users, enabling stress-free management of sales tax responsibilities while fostering confidence in their calculations.

Comprehensive Compliance Monitoring

Kintsugi offers Comprehensive Compliance Monitoring, allowing users to track tax exposure and registration statuses effortlessly. This valuable feature alerts users to changes in regulations and ensures timely filings, significantly reducing the risk of penalties and ensuring smooth operation across jurisdictions.

User-Friendly Integrations

Kintsugi features User-Friendly Integrations with popular platforms like Shopify and QuickBooks. This remarkable capability enables businesses to automate their sales tax processes seamlessly, ensuring a smooth transaction experience and saving valuable time and resources for users focused on their business growth.