Monarch Money

About Monarch Money

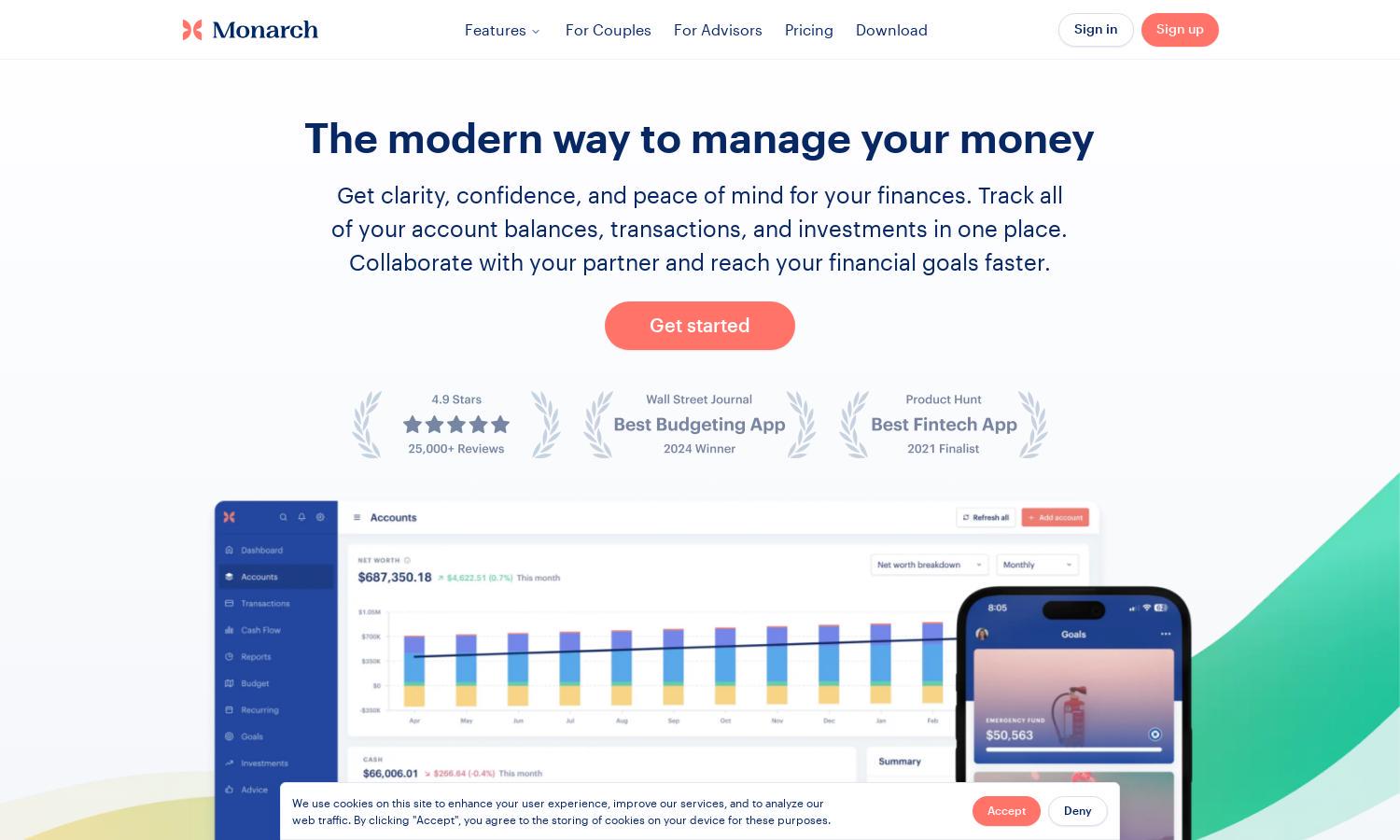

Monarch Money is a comprehensive personal finance platform designed for individuals and families seeking financial clarity. With features like investment tracking, budget management, and collaboration tools, users can optimize their financial strategies. Monarch's innovative dashboard and security measures empower users to achieve their financial goals.

Monarch Money offers competitive pricing plans that cater to different user needs. For new users, there's a discount code for 30% off the first year. Pricing tiers provide access to premium features, such as investment tracking and budgeting tools, enhancing the financial management experience for users.

Monarch Money's user interface boasts an intuitive layout, ensuring a seamless and efficient browsing experience. The visually appealing design includes customizable dashboards and easy navigation through financial reports and goals, making it user-friendly for individuals looking to enhance their personal finance management.

How Monarch Money works

To get started with Monarch Money, users sign up for an account and connect all their financial accounts for comprehensive tracking. They can explore features like budget creation, investment analysis, and collaborative tools with partners or advisors. The platform's AI-enhanced tools help organize transactions and assist users toward achieving their financial goals.

Key Features for Monarch Money

All-in-one financial management

Monarch Money's all-in-one financial management feature allows users to track accounts, budgets, and investments seamlessly. This unique functionality provides a holistic view of finances in one place, empowering users to make informed decisions and manage their money more effectively.

Collaborative finance tracking

The collaborative finance tracking feature of Monarch Money enables users to invite partners or financial advisors for joint financial management. This enhances accountability and decision-making, making it easier to set and achieve shared financial goals without additional costs or complications.

AI-driven transaction organization

Monarch Money utilizes AI-driven tools to automatically clean and categorize transactions, ensuring users maintain organized financial records. This unique feature adapts over time, enhancing the overall user experience by making money management more efficient and less cumbersome.