Pennyflo

About Pennyflo

Pennyflo is an advanced cash management platform designed for businesses aiming to optimize financial processes. Featuring real-time cash flow visualization, AI-driven forecasts, and automated workflows, Pennyflo enhances decision-making and collaborates seamlessly within teams. It addresses cash flow challenges, making it indispensable for finance teams.

Pennyflo offers flexible pricing plans tailored to various business needs. Each tier provides unique features, from basic cash flow automation to comprehensive financial analytics. Users enjoy significant savings with annual subscriptions and access to exclusive functionalities. Upgrading enhances business insights and operational efficiency with Pennyflo.

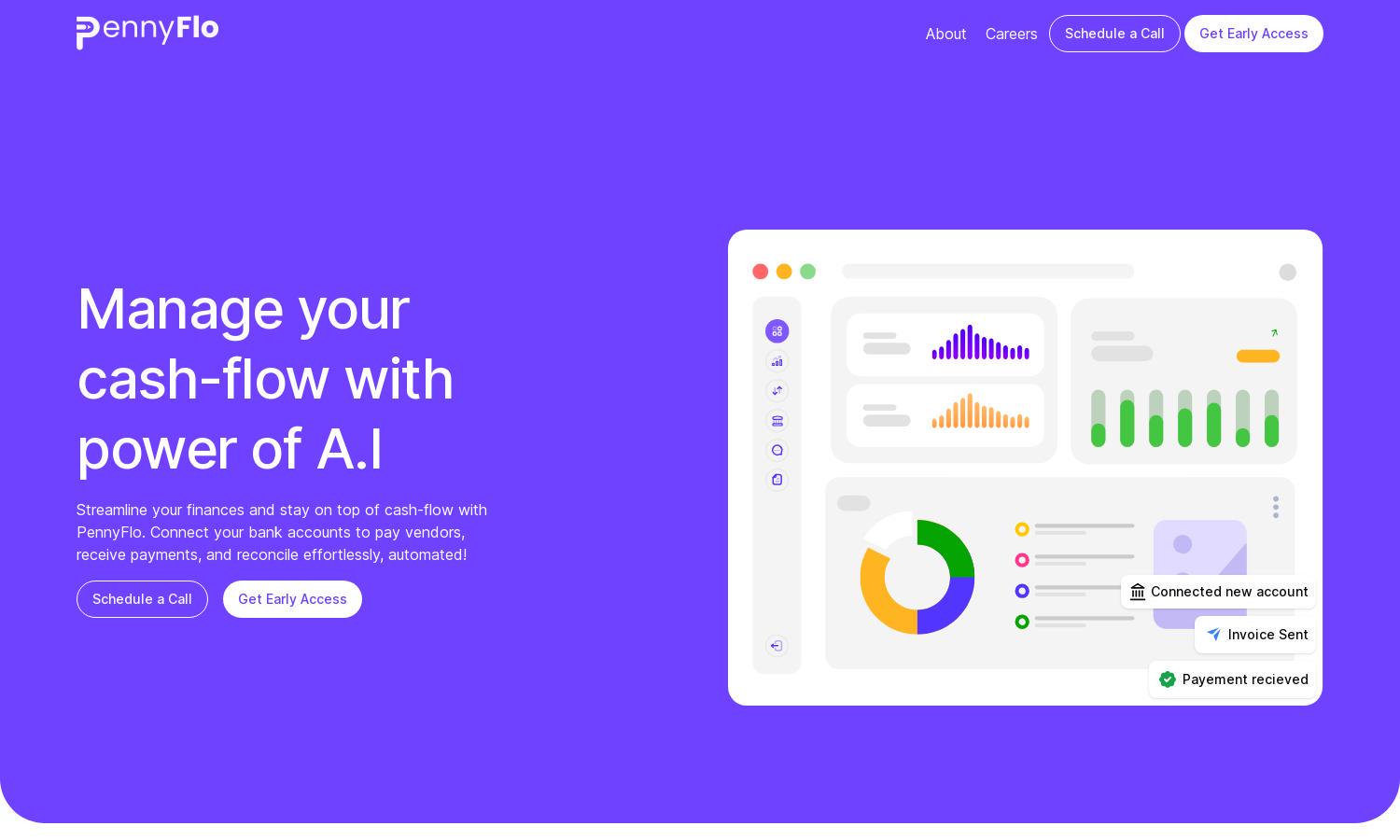

Pennyflo's user interface is designed for a seamless experience, featuring an intuitive layout that facilitates easy navigation. Users can quickly access key features like cash flow reports and banking tools, ensuring a smooth workflow. The visually appealing interface enhances usability and keeps users engaged with Pennyflo.

How Pennyflo works

Users begin by onboarding into Pennyflo, where they easily integrate their financial accounts. The platform provides a unified view of their cash flow in real time, enabling users to automate routine tasks like reconciliations. With dynamic forecasting tools, users can simulate different financial scenarios and make informed decisions using data visualizations, enhancing productivity throughout the process.

Key Features for Pennyflo

AI-Powered Cash Management

Pennyflo features cutting-edge AI-powered cash management that revolutionizes how businesses handle their finances. This innovative functionality streamlines processes, automating routine tasks and allowing teams to focus on strategic decision-making while effectively mitigating cash flow risks, positioning Pennyflo as a leader in finance tech.

Real-Time Cash Flow Visualization

With Pennyflo's Real-Time Cash Flow Visualization, users can view their financial data at a glance. This powerful tool allows businesses to monitor cash positions dynamically, enabling informed decisions and proactive management of financial health. Experience unparalleled insight with Pennyflo's advanced visualization capabilities.

Automated Banking and Reconciliations

Pennyflo offers Automated Banking and Reconciliations to simplify financial management for businesses. This feature ensures accuracy and efficiency, significantly reducing the time spent on manual processes. By integrating banking data automatically, Pennyflo enhances operational productivity, allowing teams to focus more on strategic initiatives.

You may also like: