Sixfold

About Sixfold

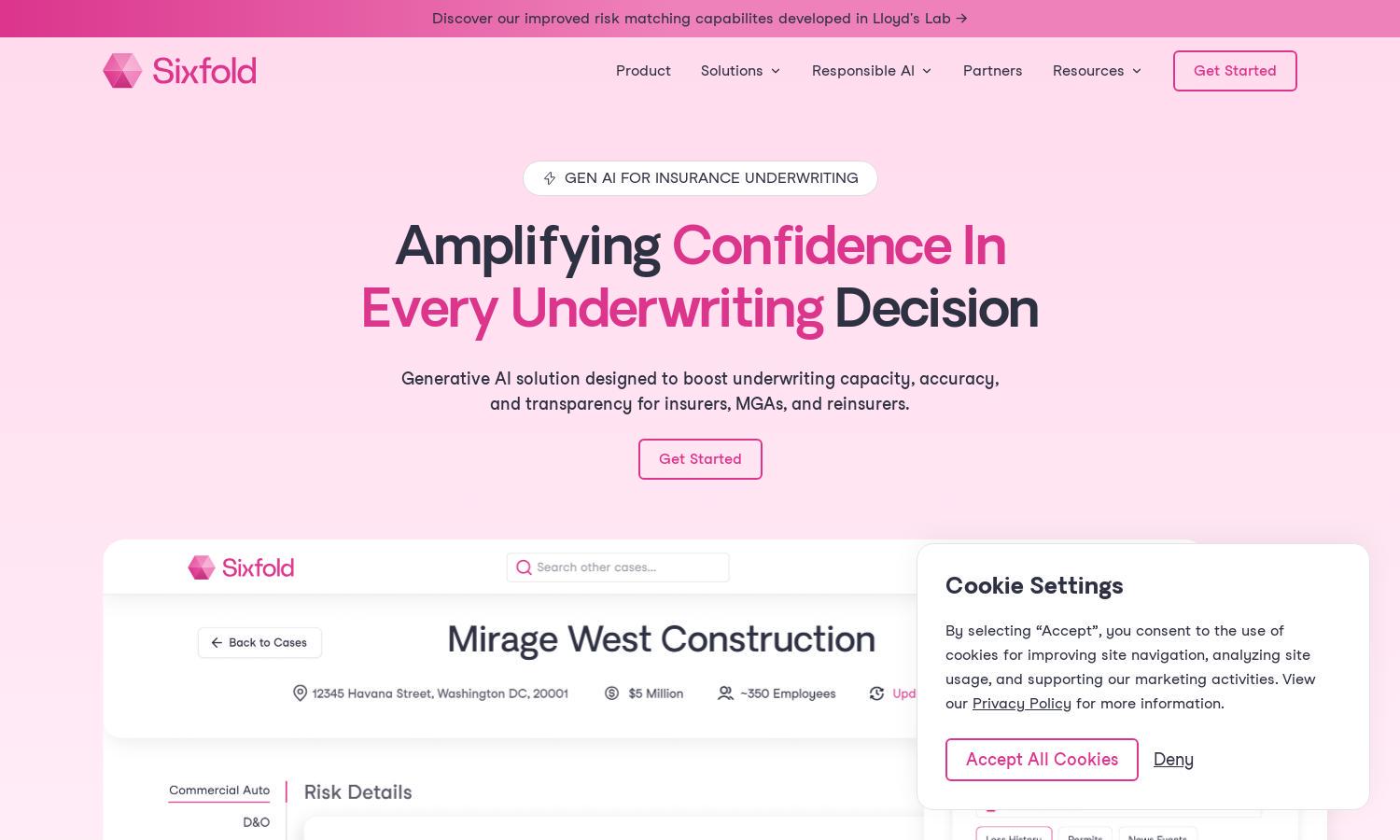

Sixfold is dedicated to revolutionizing insurance underwriting through innovative generative AI solutions tailored for underwriters. It streamlines workflows by automating data ingestion and risk assessment, delivering precise recommendations aligned with users' risk appetites, and ensures full transparency for compliance, making it an essential tool for the insurance industry.

Sixfold offers flexible pricing plans tailored to the needs of insurance underwriters. Each tier provides access to advanced generative AI capabilities, with special discounts available for annual subscriptions. Upgrade to unlock premium features that enhance automation and accuracy, ensuring a competitive edge in the underwriting process.

The user interface of Sixfold is designed for seamless navigation, featuring an intuitive layout that guides users through underwriting tasks. Unique elements, such as customizable dashboards and clear data visualization, enhance the user experience, allowing underwriters to efficiently leverage insights to make informed decisions.

How Sixfold works

Users of Sixfold start by ingesting their underwriting guidelines into the system, which then identifies relevant risk factors. The platform collects data from submissions and third-party sources, presenting tailored recommendations based on the user's unique risk appetite. Its intuitive design ensures a user-friendly experience, allowing underwriters to quickly access insights and make informed decisions.

Key Features for Sixfold

Generative AI Co-Pilot

The generative AI co-pilot feature of Sixfold revolutionizes underwriting by automating mundane tasks. This cutting-edge technology enhances efficiency, allowing underwriters to focus on critical decision-making, ultimately improving accuracy and speeding up the underwriting process while ensuring full compliance.

Transparent Decision-Making

Sixfold ensures transparent decision-making with complete traceability of all underwriting decisions. Users benefit from full sourcing and lineage, removing any black box confusion, thus fostering trust and compliance within the underwriting process while maintaining clear data integrity.

Risk Signal Detection

Risk signal detection is a standout feature of Sixfold that highlights positive, negative, and disqualifying risk factors. This capability enables underwriters to quickly identify potential issues, streamlining the review process and allowing for more informed, data-driven decisions.

You may also like: