Teragonia

About Teragonia

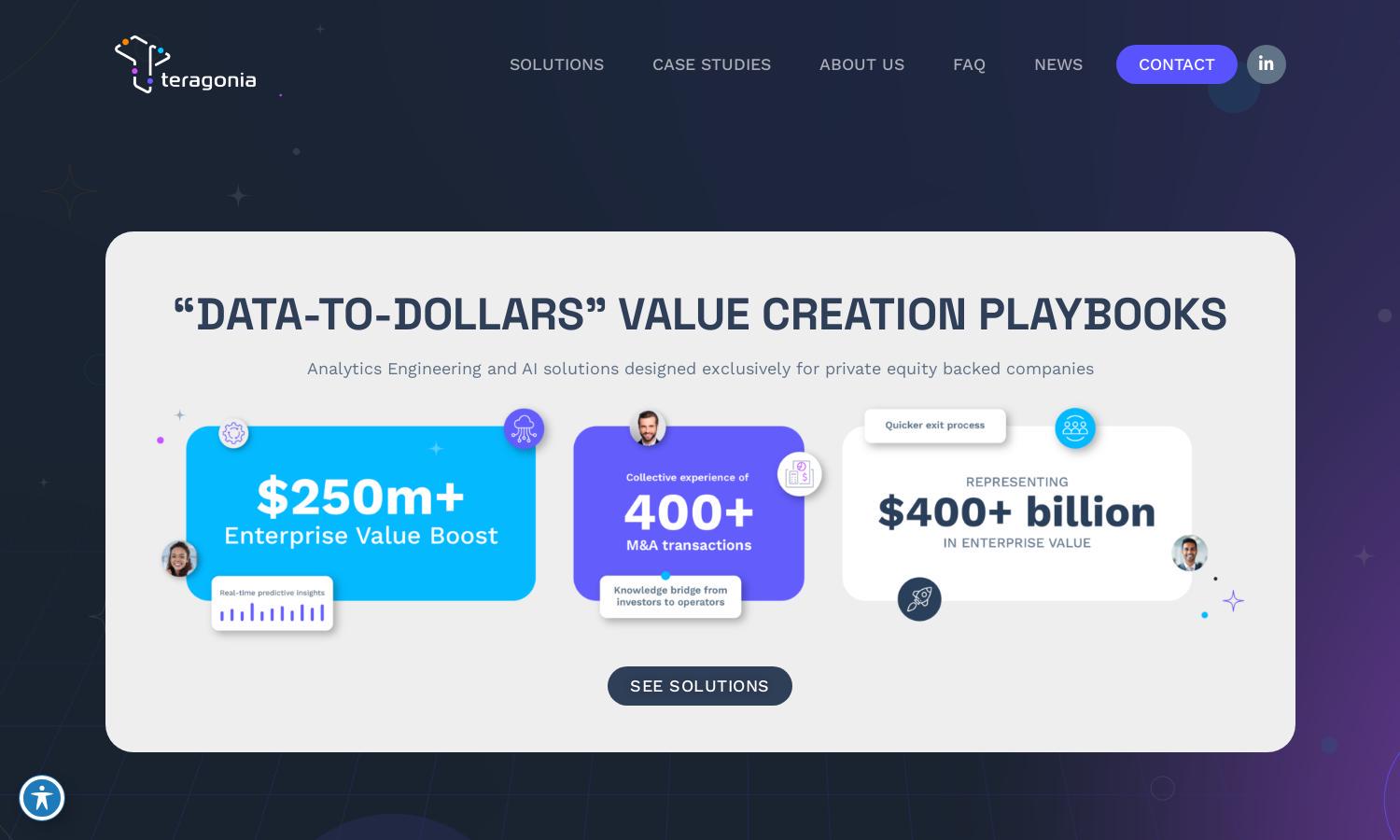

Teragonia is a leading provider of analytics engineering and AI solutions designed for private equity-backed and founder-owned companies. By offering high-fidelity data and real-time decision-making tools, Teragonia enhances investment returns and streamlines operations, addressing challenges related to poor data quality and inefficient value creation processes.

Teragonia offers flexible pricing plans tailored to meet the needs of different organizations. Each tier provides varying levels of analytics and AI solutions, ensuring businesses receive maximum value based on their investment. Special discounts may be available for long-term partnerships, enhancing value for users seeking comprehensive support.

Teragonia boasts an intuitive user interface that prioritizes seamless navigation and ease of use. With a user-friendly layout, clients can easily access vital data and insights, optimizing their investment strategies. Features like live KPI reporting facilitate quick decision-making, further enhancing the overall user experience on Teragonia.

How Teragonia works

At Teragonia, users begin their journey through a comprehensive onboarding process designed to align analytics and AI solutions with specific business needs. After initial setup, users navigate a user-friendly interface that provides access to real-time data insights, high-fidelity reporting, and collaboration tools. The platform emphasizes ease of integration and data flow, enabling private equity firms and founder-led organizations to drive EBITDA gains effectively through informed decision-making.

Key Features for Teragonia

End-to-End Analytics Solutions

Teragonia’s end-to-end analytics solutions streamline data processes, empowering companies to make informed decisions swiftly. By providing high-fidelity data and real-time insights, Teragonia enhances value creation for private equity firms and founder-owned businesses, enabling them to capture untapped potential effectively.

Real-Time KPI Reporting

Teragonia offers real-time KPI reporting, allowing organizations to visualize performance metrics instantly. This feature enables private equity firms to make timely, data-driven decisions, ultimately driving better investment strategies and maximizing returns on portfolio companies through informed action and strategic planning.

White-Glove Service Delivery

Teragonia provides white-glove service delivery, ensuring personalized support for clients throughout their analytics journey. This tailored approach allows organizations to focus on core operations while leveraging advanced analytics solutions, optimizing investment outcomes and allowing for quick adaptations in a competitive market landscape.

You may also like: