Kniru

About Kniru

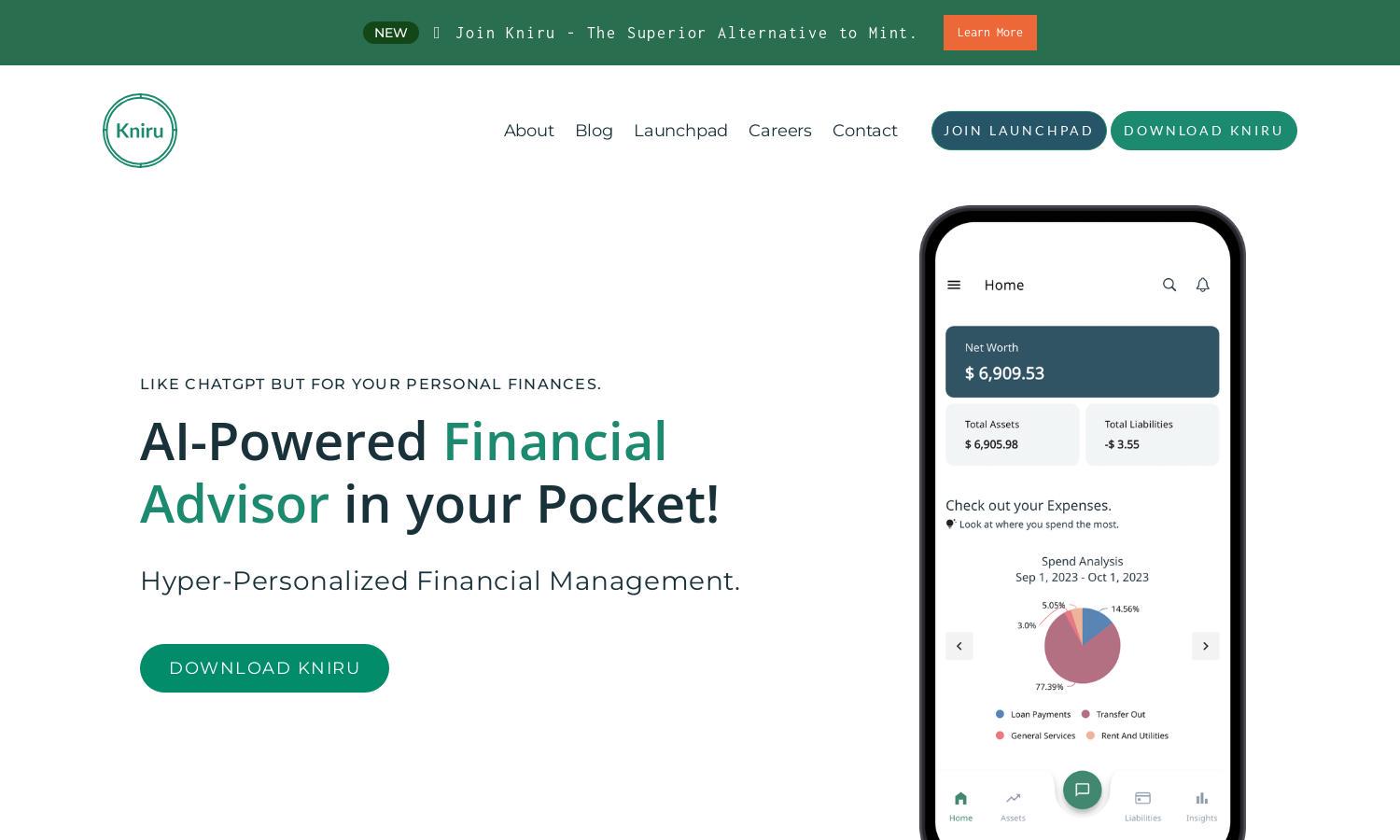

Kniru serves as an innovative AI-powered financial advisor, helping users understand and manage their finances effectively. With features like personalized insights, budget alerts, and financial planning tools, it empowers individuals to make informed decisions and improve their financial health seamlessly.

Kniru offers a free tier with basic features, while premium plans unlock advanced insights and personalized advice. Subscribing provides access to exclusive tools and additional support, making upgrading an attractive option for users looking to enhance their financial management and advisory experience.

Kniru's user interface is designed for simplicity, ensuring a seamless experience with easy navigation. Features are intuitively laid out, allowing users to quickly access financial insights, set alerts, and manage accounts effectively, thus enhancing overall usability and engagement with the platform.

How Kniru works

To get started with Kniru, users simply download the app and create an account. During onboarding, they can link various bank accounts, enabling the AI to analyze their finances. Once set up, users can interact with Kniru through chat, receive tailored financial advice, set alerts, and monitor spending, all within a user-friendly interface designed to enhance financial management.

Key Features for Kniru

AI-Powered Chat Interface

Kniru’s AI-powered chat interface offers users immediate access to personalized financial insights and advice. This innovative feature supports a human-like conversational experience, helping users to ask questions and receive tailored guidance on wealth management, retirement planning, and more effectively.

Automated Financial Notifications

Kniru provides automated financial notifications, helping users stay informed about important account activities. With alerts for bill reminders, budget overspending, and portfolio changes, this feature ensures users can take prompt actions, ultimately enhancing their financial management and planning efforts.

Comprehensive Dashboard Insights

Kniru features a comprehensive dashboard that consolidates users' assets and liabilities in one place. With detailed spend analysis and subscription tracking, this unique feature empowers users to visualize their financial health and make data-driven decisions effectively.

You may also like: