Skwad

About Skwad

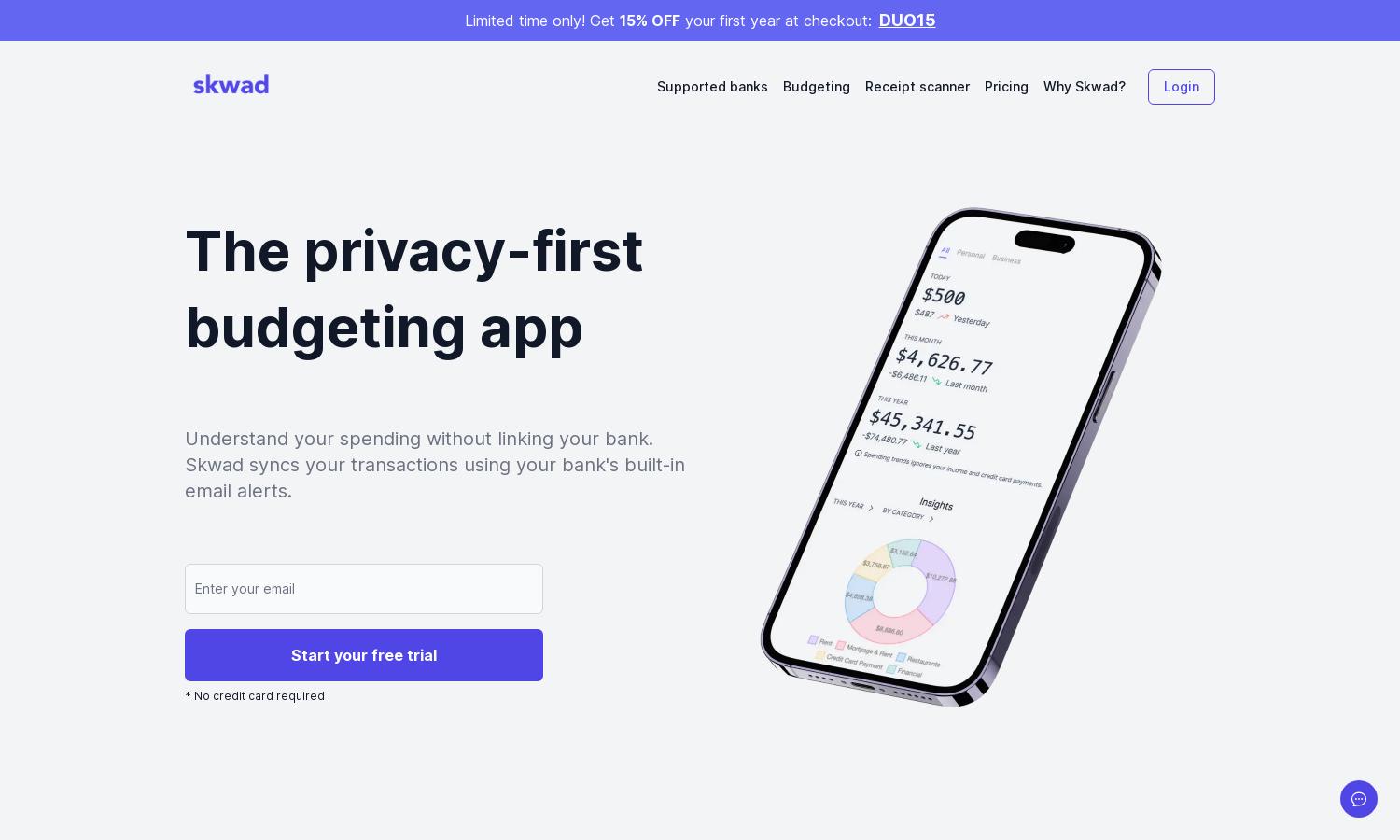

Skwad is a revolutionary budgeting app designed for privacy-conscious users. It enables seamless transaction tracking through bank email alerts, eliminating the need for direct login credentials. Users benefit from instant categorization, minimizing manual entry and enhancing financial clarity while prioritizing their security and privacy.

Skwad offers flexible pricing plans catering to different user needs, including a free trial. Users can enjoy a discount of 15% OFF their first year with code DUO15. Each tier provides unique features, enhancing budgeting capabilities while maintaining user privacy and security.

Skwad boasts an intuitive and user-friendly interface that simplifies budgeting and financial management. The streamlined design enhances navigation, making it easy for users to access features like transaction tracking, categorization, and alerts. This layout fosters an enjoyable browsing experience while focusing on user convenience.

How Skwad works

Users start by signing up for Skwad and receiving a unique scan email address. They then set up automated alerts from their bank, forwarding email alerts to Skwad for instant processing. With these alerts, Skwad categorizes transactions, enabling users to visualize spending and track their financial journey effortlessly.

Key Features for Skwad

Automated Transaction Categorization

Skwad's automated transaction categorization feature revolutionizes budgeting. By processing bank email alerts, it instantly organizes spending into user-defined categories. This unique approach saves users time and effort, allowing them to focus on understanding their finances without the hassle of manual entry.

Privacy-First Approach

Skwad's privacy-first approach sets it apart from typical budgeting apps. By eliminating the need for bank login information, it protects users' sensitive data while offering reliable transaction tracking. This unique feature empowers users with peace of mind, allowing them to manage finances securely and privately.

Multi-User Collaboration

Skwad offers a multiplayer mode that allows users to invite companions for shared budgeting and financial insights. This collaborative feature enhances accountability and encourages collective debt elimination, making it easier for users to achieve their financial goals together with trusted partners.