Private Equity List

Find and connect with the right PE and VC investors using our AI-powered database.

Visit

About Private Equity List

Private Equity List is an AI-powered database designed to streamline the process of finding and connecting with private equity and venture capital investors. It serves as a practical, best-value alternative to expensive, complex platforms like Pitchbook and Crunchbase. The platform provides a super-intuitive search system with powerful, PE/VC-specific filters, enabling users to quickly build targeted investor lists based on geography, investment stage, thesis, and more. It goes beyond simple listings by providing enriched data, including direct contacts for investment teams and detailed fund information, all updated nearly daily. With its lightweight, user-friendly interface, Private Equity List is built for efficiency, helping startups, consultants, VC funds, and researchers cut through the noise and get from search to actionable investor data in minutes. Its core mission is to make high-quality PE/VC intelligence accessible and export-ready at a much more affordable price point, democratizing access to the data needed for successful fundraising, partnerships, and market research.

Features of Private Equity List

AI-Powered Search

This feature allows you to find investors using natural language queries. Simply describe your company, stage, or sector, and the AI will surface relevant PE/VC funds. It's designed to accelerate initial research and brainstorming, though users are advised to verify details for accuracy. This chat-based approach provides a fast, intuitive entry point compared to manually configuring multiple filters from the start.

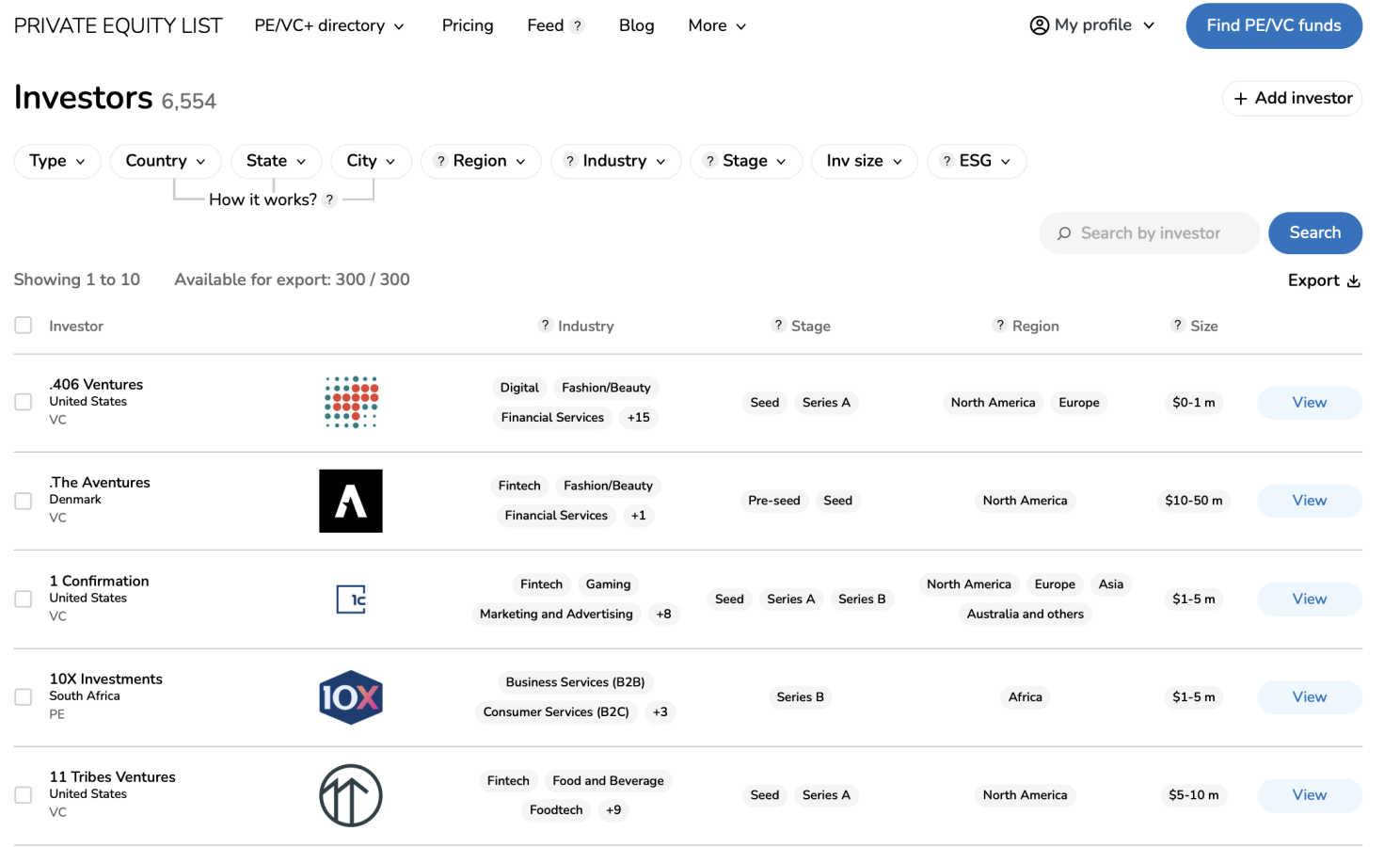

Super-Intuitive Search & Filters

The platform's core strength is its highly targeted filtering system built specifically for private equity and venture capital. You can drill down by precise criteria such as geographic focus, investment stage (from pre-seed to Series C+), check size, and investment thesis. This ensures the results are immediately relevant, saving hours of manual sorting through generalized or irrelevant data found on other platforms.

Investor Contact Enrichment

Private Equity List provides direct access to contact information for investment team members, including their roles. This data is export-ready in bulk via .CSV files, enabling efficient outreach campaigns. Unlike some competitors that lock this crucial data behind exorbitant paywalls or complex enterprise plans, these enriched contacts are available at a much more affordable price point.

Curated & Updated Database

The database features over 7,000 PE/VC investors and 27,000+ investment team contacts worldwide, with a focus on active funds. The data is human-curated and updated nearly daily, ensuring you're working with current opportunities, including newly launched funds eager to invest. This reliable, structured data is verified for fundraising purposes, unlike AI-only models that may hallucinate or provide unverified information.

Use Cases of Private Equity List

Startup Fundraising

Founders can raise capital faster by identifying perfect-fit investors in seconds. Filter by your startup's stage, location, required check size, and the investor's sector focus to build a targeted shortlist. The platform helps you move quickly from idea to a structured list of actionable leads, connecting you directly with the right investment team contacts to streamline your entire fundraising process.

Consultant & Advisor Work

Consultants and financial advisors can close client mandates faster by creating tailored investor or buyer shortlists for fundraising and M&A deals. The ability to quickly generate, filter, and export precise lists with contact details allows for efficient deal sourcing and outreach, helping to secure success fees more rapidly by providing clients with high-quality, actionable intelligence.

VC Ecosystem Networking

VC funds, accelerators, and venture studios use the platform to find co-investors and strategic partners across the global landscape. With access to data on over 6,000 funds, you can identify complementary firms to syndicate deals, support portfolio companies in their next rounds, and build a stronger network within the investment community to boost overall portfolio performance.

Academic & Market Research

Universities, journalists, government agencies, and researchers leverage the platform for in-depth PE/VC market intelligence. The exportable, structured data is ideal for analyzing investment trends, mapping the venture landscape in specific regions or sectors, and creating authoritative reports without the analytics overload and high cost associated with enterprise-grade solutions.

Frequently Asked Questions

What makes Private Equity List different from Pitchbook or Crunchbase?

Private Equity List is a specialized, lightweight, and more affordable alternative. It focuses exclusively on PE/VC data with intuitive, targeted filters, whereas larger platforms are generalist databases with complex analytics that lead to a steeper learning curve and significantly higher pricing. We prioritize getting you a usable, export-ready investor list quickly and at the best value.

How accurate and current is the data?

Our database is human-curated and updated nearly daily to ensure high accuracy and relevance. We specifically track active funds and new fund launches. While our AI search is a powerful tool for ideation, we recommend cross-checking critical details, as with any source. Our core filtered database is maintained with a focus on providing reliable data for fundraising and professional use.

Can I export the investor lists and contacts?

Yes, a key feature is the ability to export your filtered investor lists, including enriched contact information such as names and roles of investment team members, directly into a .CSV file. This makes it easy to integrate the data into your CRM or outreach campaigns, a functionality often locked behind expensive paywalls on other platforms.

Is there a free trial or a free plan?

Yes, you can try Private Equity List for free. The platform offers basic functions at no cost and does not require a credit card to start. This allows you to experience the intuitive search and filtering system firsthand to see how it can solve your investor sourcing needs before committing to a paid plan.

You may also like:

Fieldtics

Fieldtics is an all-in-one platform for service businesses, streamlining scheduling, customer management, invoicing, and getting paid.

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

Tailride

AI-powered invoice and receipt automation from email and web portals